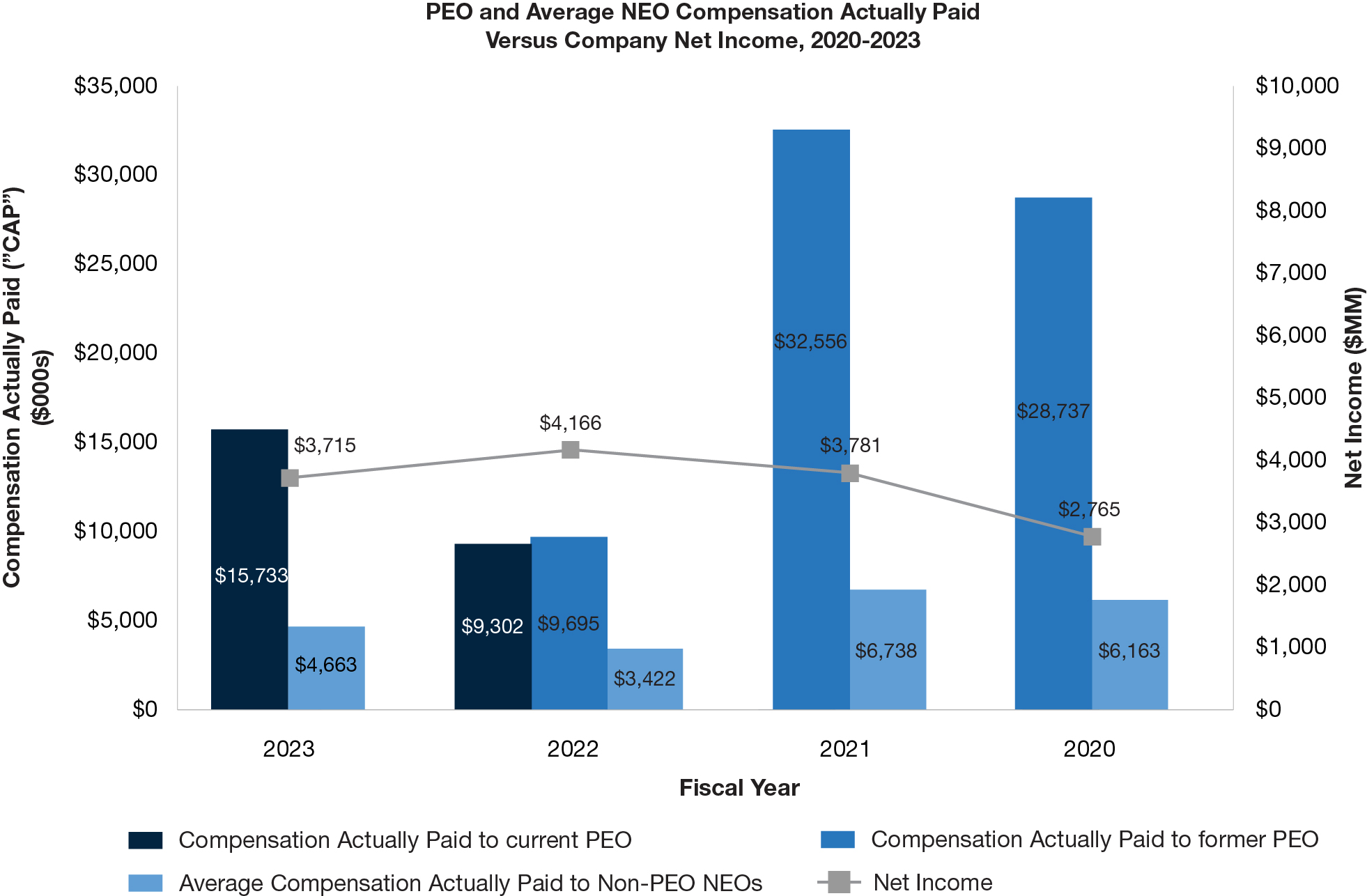

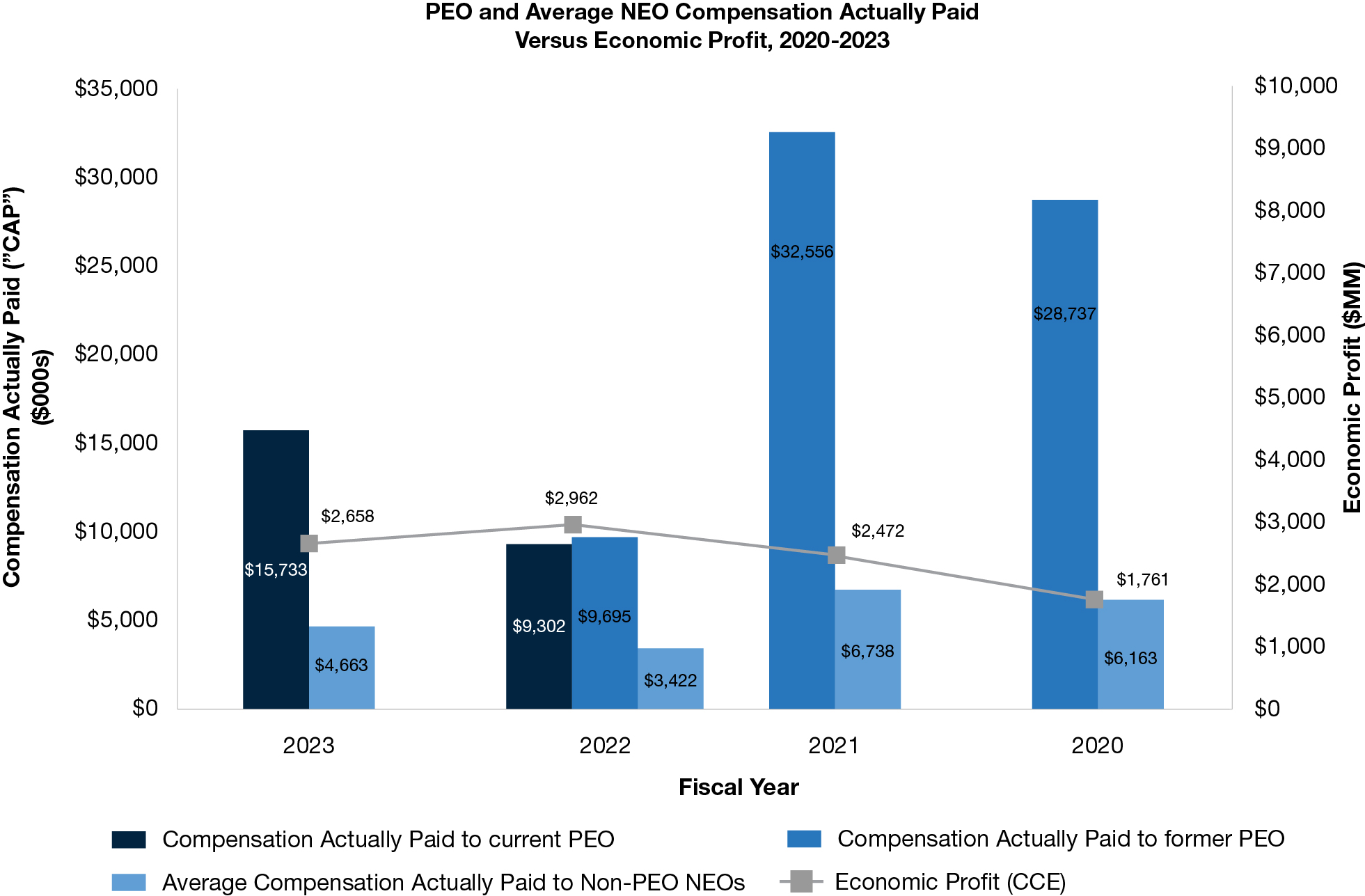

Table

Compensation Discussion and Analysis | Compensation Decisions

2023 Compensation Decisions

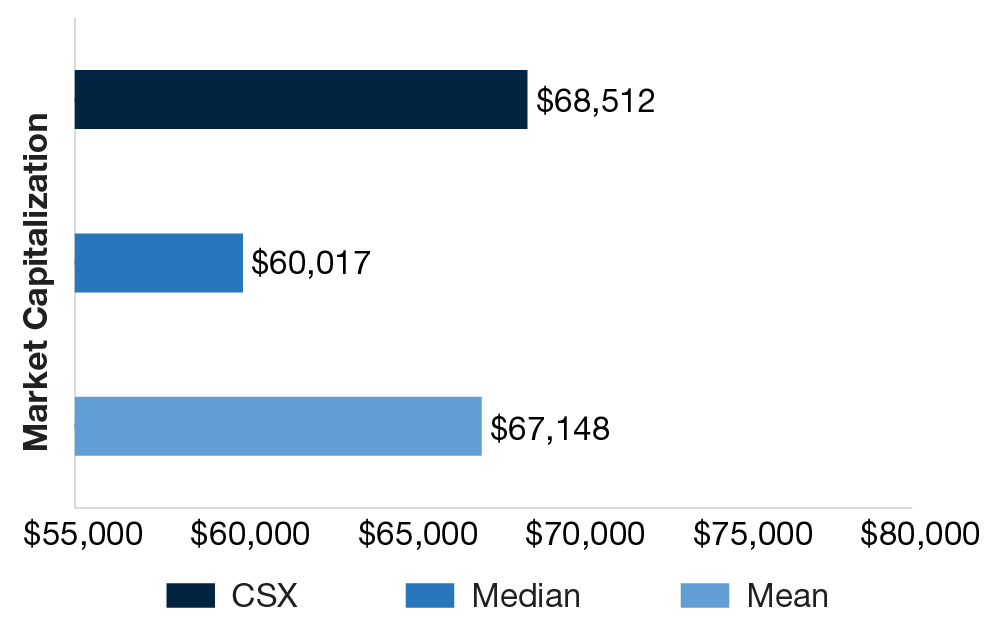

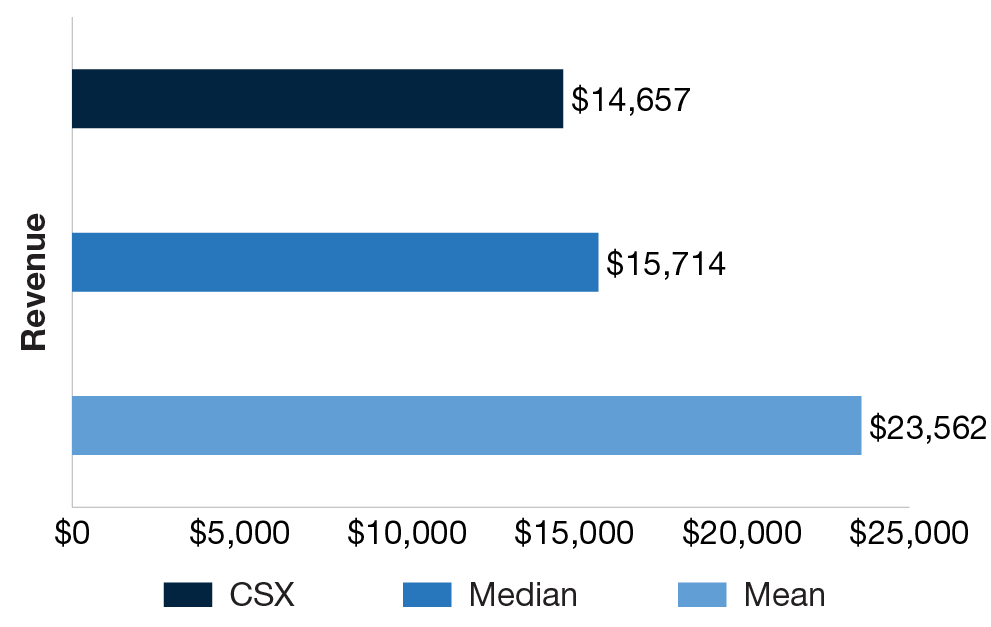

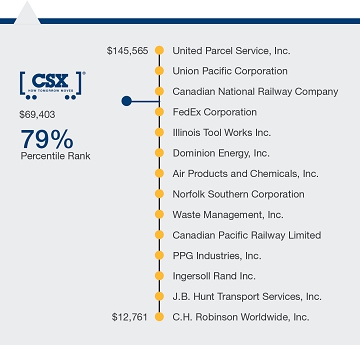

In September 2022, the Board appointed Mr. Hinrichs as President and CEO to continue driving the Company’s growth and delivering for our shareholders, based on his proven and relevant track record around operational excellence, serving customers and building a company culture of trust and strong employee engagement. The Committee approved an overall compensation package for Mr. Hinrichs intended to strike the appropriate balance of fairly compensating him relative to peers, the Comparator Group and other S&P 500 CEOs, while aligning with shareholder expectations.

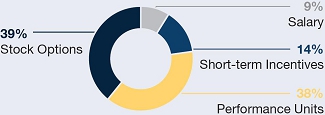

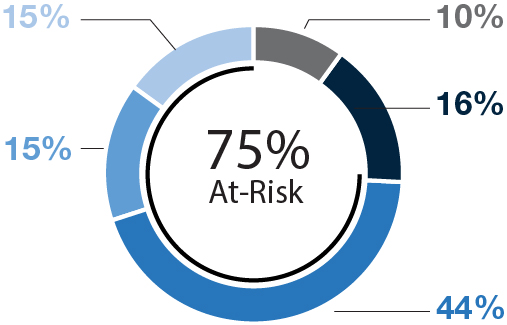

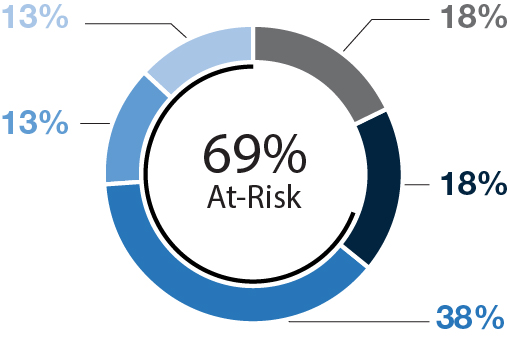

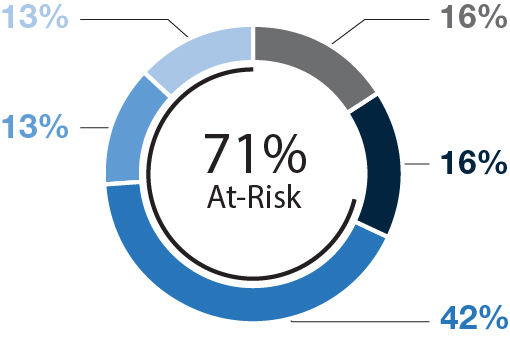

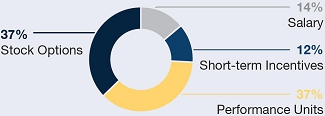

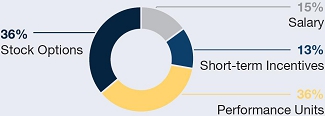

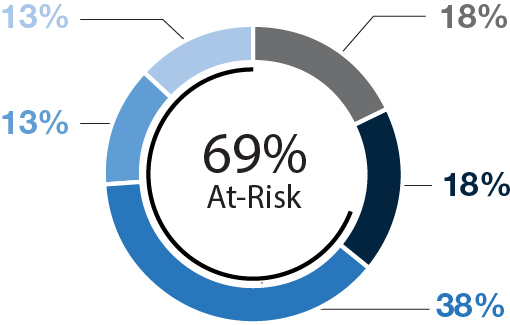

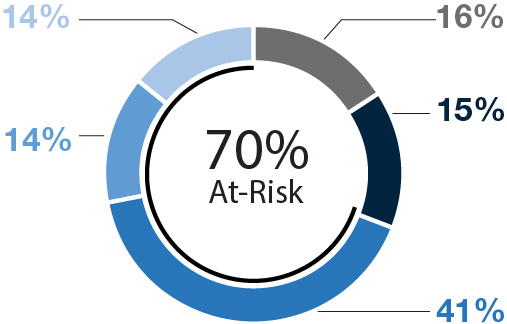

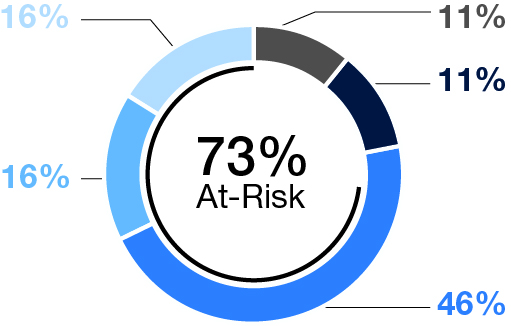

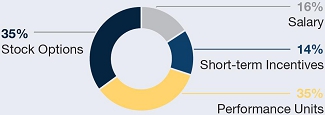

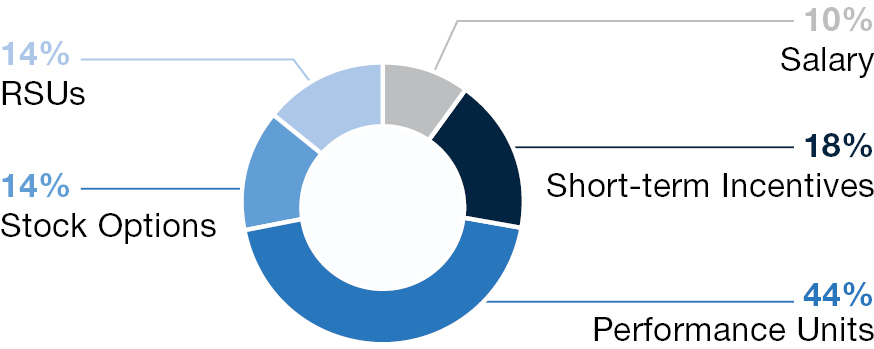

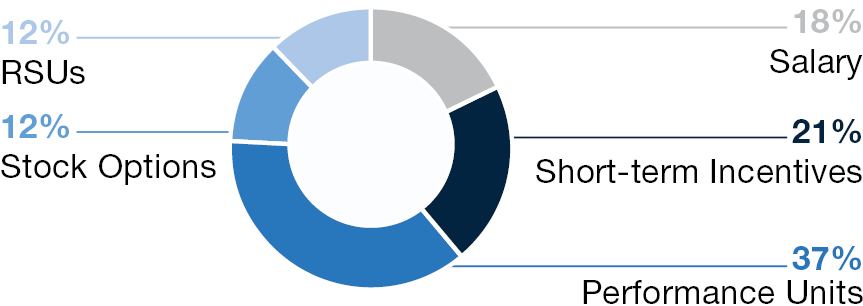

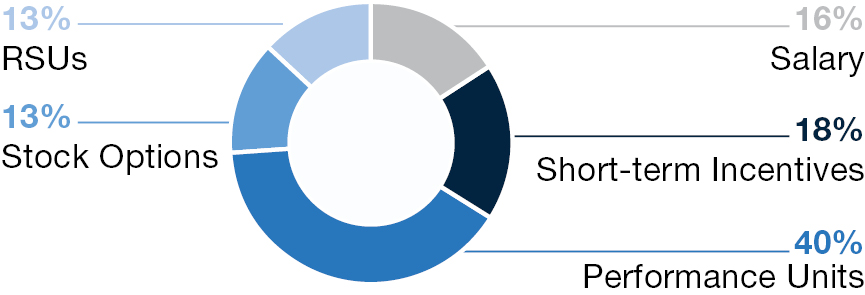

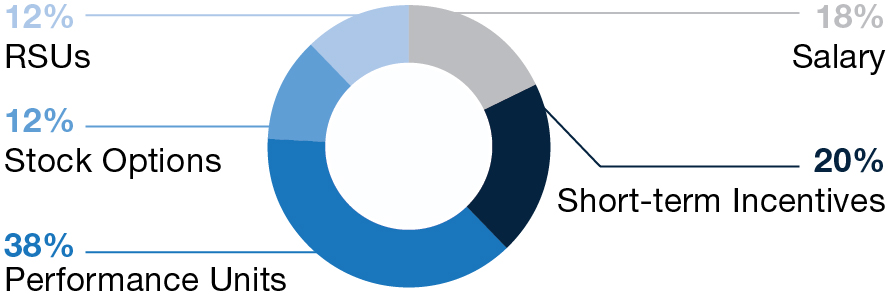

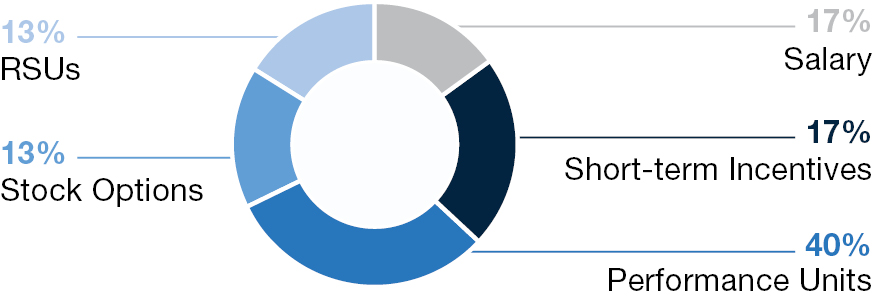

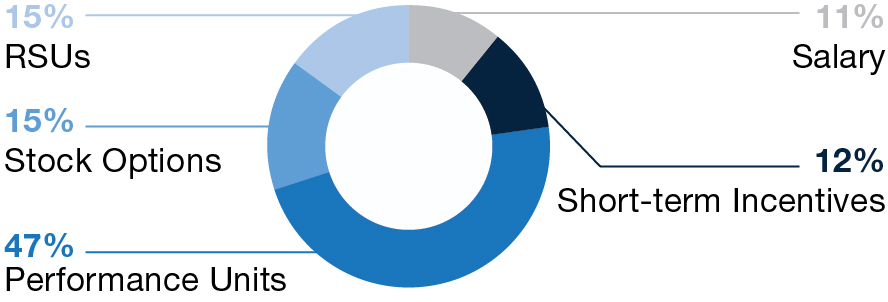

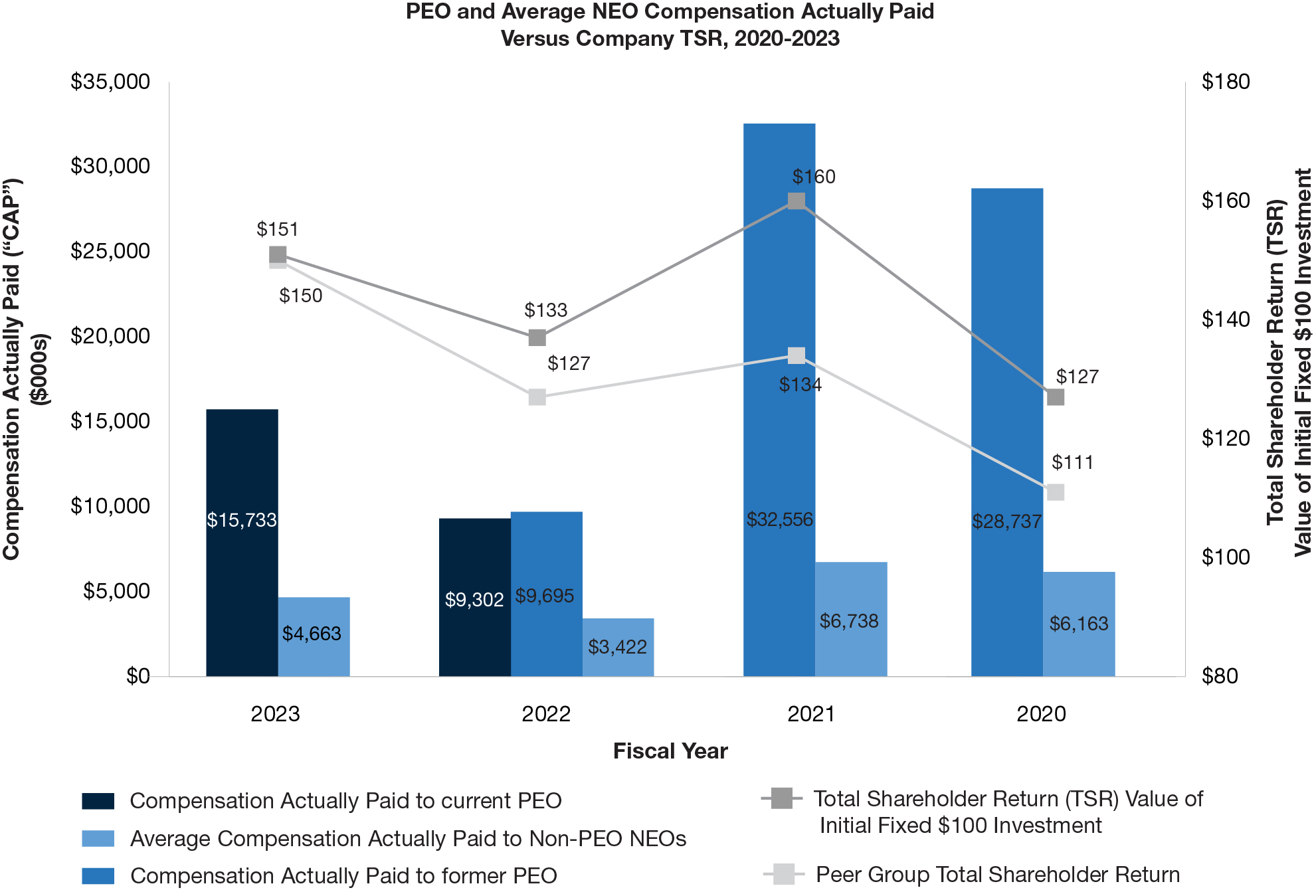

To better demonstrate and provide support for our 2023 compensation decisions, the scorecards below include biographical information and career highlights for each NEO, along with their respective 2023 accomplishments and an overview of their actual compensation. Unlike the charts above, which show the target compensation mix for each of the NEOs, the actual compensation charts below include 2023 base salary earnings, 2023 MICP payouts based on Company and individual performance and long-term incentives (“LTIs”) granted in 2023. The percentage of LTIs that is performance based is calculated by the amount of performance units granted divided by the total LTI awards granted.

Compensation Discussion and Analysis | Compensation Decisions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | Joseph R. Hinrichs, 57 President and Chief

Executive Officer Tenure 1.5 years | | | | | Sean R.

Pelkey, 44 Executive Vice President and Chief Financial Officer Tenure 18.7 years |

| | | | | | | | | | |

| Responsibilities | | | Responsibilities |

| Mr. Hinrichs joined CSX in September 2022 as President and Chief Executive Officer. Mr. Hinrichs has more than 30 years of experience in the global automotive, manufacturing operations and energy sectors. Prior to joining CSX, he served as President of Ford Motor Company’s automotive business. He began his career with General Motors in 1989 as an engineer and quickly ascended into management. Between management roles at Ford and General Motors, Mr. Hinrichs oversaw investments in small entrepreneurial businesses for Ryan Enterprises, a private equity firm. Mr. Hinrichs brings to CSX a commitment to operational excellence, experience building global businesses through investment in people and culture and a deep understanding of balancing safety and efficiency in a complex industry. | | | Mr. Pelkey was named Vice President and Acting Chief Financial Officer in June 2021, and promoted to Executive Vice President and Chief Financial Officer in January 2022. In this role, he is responsible for all financial aspects of the Company’s business, including financial and economic analysis, accounting, tax, treasury and purchasing activities. Mr. Pelkey has more than 18 years of experience in finance, investor relations and financial planning. Since joining CSX in 2005, he has held a variety of finance management roles, including Vice President – Finance and Assistant Vice President of Capital Markets, as well as several director and managerial roles in investor relations, financial planning and IT finance. |

| 2023 Accomplishments | | | 2023 Accomplishments |

| nAdvanced ONE CSX culture, including implementing recurring employee engagement surveys, holding all-employee quarterly town halls, supporting Business Resource Groups (BRGs) and increasing employee participation in community and CSX-sponsored events. Results include an increase in the CSX employee trust score, Glassdoor improved rankings and being named one of America’s Greatest Workplaces for Diversity by Newsweek and Best Place to Work for Disability Inclusion by Disability:IN. nDrove strategies to create long-term and profitable business, including merchandise, intermodal initiatives, TRANSFLO and completion of the integration of Pan Am. nDrove operational improvements including Total Trip Plan Compliance YoY improvement of 20%, Network Velocity YoY improvement of 12%, Network Dwell YoY improvement of 17% and Customer Switch Performance YoY improvement of 12%. nLowest number of personal injuries among the Class I railroads but reaffirmed the need to further enhance safety training and diligence for all employees in light of three employee fatalities in 2023. nSuccessfully negotiated leading edge paid sick time benefits policies for employees who are covered under a collectively bargained agreement. | | | nDelivered $220 million of direct value across departments, including tax and insurance program efficiencies, interest rate swaps and procurement activities on goods and services. nFacilitated a working team towards the production of hydrogen locomotives at our Huntington location and secured a deal to operate battery-electric locomotives at our Port of Baltimore location. nRepositioned cash during the regional banking scrutiny to mitigate CSX risk, along with extending the Company’s credit facility for another five years to ensure access to liquidity if needed during highly disruptive events. nHelped foster a more cohesive ONE CSX culture within the Finance organization and the broader Company through a series of strategic grassroots initiatives aimed at increasing collaboration, employee development and community involvement. |

| 2023 Actual Compensation | | | | 2023 Actual Compensation |

| | | | |

| Base Salary: | | | $ | 1,400,000 | | | | Base Salary: | | | $ | 660,000 | |

| Annual Bonus Earned: | $ | 2,415,000 | | | | Annual Bonus Earned: | $ | 759,000 | |

| Long-Term Incentives Granted: | $ | 10,000,035 | | | | Long-Term Incentives Granted: | $ | 2,325,019 | |

| Total Actual Compensation: | $ | 13,815,035 | | | | Total Actual Compensation: | $ | 3,744,019 | |

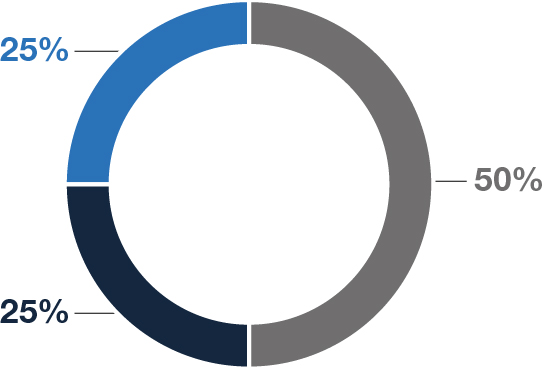

| 60% of 2023 LTIs granted were performance based | | | 60% of 2023 LTIs granted were performance based |

Compensation Discussion and Analysis | Compensation Decisions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | Kevin S.

Boone, 47 Executive Vice President and Chief Commercial Officer Tenure 6.5 years | | | | | Stephen

Fortune, 54 Executive Vice President and Chief Digital & Technology Officer Tenure 2.0 years |

| | | | | | | | | | |

| Responsibilities | | | Responsibilities |

| Mr. Boone has served as Executive Vice President and Chief Commercial Officer since June 2021. In this role, he is responsible for developing and implementing the Company’s commercial strategy. Mr. Boone previously served as Executive Vice President and Chief Financial Officer from October 2019 until June 2021. Mr. Boone has more than 20 years of experience in finance, accounting, mergers and acquisitions and transportation performance analysis. He joined CSX in September 2017, as Vice President – Corporate Affairs, and was later named Vice President – Sales & Marketing leading research and data analysis to advance growth strategies for CSX. | | | Mr. Fortune joined CSX in April 2022 as Executive Vice President and Chief Digital & Technology Officer. Mr. Fortune is responsible for leading CSX’s technology strategy development and implementation and supporting business growth through innovative digital solutions, as well as overseeing all aspects of the Company’s information technology systems operations. Mr. Fortune brings decades of experience as a corporate technology leader. Prior to CSX, he served 30 years at BP, most recently as Chief Information Officer of the global BP Group. He began his BP career as a chemical and process engineer before moving into operations management and transitioning into information technology in 2003. |

| 2023 Accomplishments | | | 2023 Accomplishments |

| nExceeded total revenue plan, including growing line-haul revenue by almost $500 million, despite international headwinds impacting the Company’s export coal rates and international intermodal volume. nSignificant wins across multiple lines of business, including TRANSFLO, Westrock, LyondellBasell, multiple LPG customers, multiple automotive manufacturers and domestic intermodal partners. nTDSI AAR audit scores continue to remain high, including leading the industry at destination ramps with an almost perfect score. nFocused on leadership and skill development of the Sales and Marketing organization and support of organizational ONE CSX initiatives. | | | nRealigned strategy for the modernization of the CSX technology vision, placing the employee and customer at its core, and guided by the central focus on safety, which includes the five-year effort to replace the mainframe-based Core Dispatch system and updated tablets for the Company’s train and engine employees. nIn partnership with Sales and Marketing, transformed the ShipCSX tool with new tools that make it easier for customers to do business with CSX, in addition to introducing a user-friendly coal reservation system, Intermodal Time on Terminal tool, tracking Car Order Fill, and Automotive Supply performance tools. nFocused on proactive measures to increase cybersecurity awareness within CSX, including the implementation of robust security measures and threat partner mitigation. nLaunched the Train and Engine Portal and upgraded technological devices, significantly improving operational efficiency and creating a more collaborative ONE CSX employee work experience. |

| 2023 Actual Compensation | | | | 2023 Actual Compensation |

| | | | |

| Base Salary: | | | $ | 725,000 | | | | Base Salary: | | | $ | 650,000 | |

| Annual Bonus Earned: | $ | 833,750 | | | | Annual Bonus Earned: | $ | 747,500 | |

| Long-Term Incentives Granted: | $ | 3,150,014 | | | | Long-Term Incentives Granted: | $ | 2,325,019 | |

| Total Actual Compensation: | $ | 4,708,764 | | | | Total Actual Compensation: | $ | 3,722,519 | |

| 60% of 2023 LTIs were performance based | | | 60% of 2023 LTIs granted were performance based |

Compensation Discussion and Analysis | Compensation Decisions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | Nathan D. Goldman, 66 Executive Vice President, Chief Legal Officer and Corporate Secretary Tenure 20.7 years | | | | | |

| | | | | | | | | | |

| Responsibilities | | | |

| Mr. Goldman has served as Executive Vice President, Chief Legal Officer and Corporate Secretary of CSX since November 2017. In this role, he directs the Company’s legal affairs, government relations, risk management, public safety, environmental and internal audit functions. Mr. Goldman has previously served as Vice President of Risk Compliance and General Counsel and has overseen work in compliance, risk management and safety programs. | | | |

| 2023 Accomplishments | | | | | | |

| | | Jamie J. Boychuk, 46 Former Executive Vice President – Operations Tenure 6.2 years |

| nSupported development of key sustainability initiatives and ESG reporting, including biodiesel testing, hydrogen locomotive design and build and securing a grant for electric locomotives. nPartnered with communities to win an industry-leading $2.6 billion in public funding for projects which will increase safety, capacity, connectivity and efficiency. nIncreased first responders training and outreach to touch a total of 4,800 external partners during over 70 events to ensure readiness in the event of a community incident. nEngaged in a number of internal and external initiatives and programs targeted at strengthening ONE CSX communities. | | |

| | | | | | |

| | | Responsibilities |

| | | Mr. Boychuk was involuntarily separated without cause from his position as Executive Vice President – Operations of CSX Transportation, Inc. (“CSXT”) in August 2023. |

| 2023 Actual Compensation | | | | 2023 Actual Compensation | |

| | | | |

| Base Salary: | | | $ | 570,000 | | | | Base Salary: | | | $ | 433,424 | |

| Annual Bonus Earned: | $ | 589,950 | | | | Annual Bonus Earned: | $ | 498,438 | |

| Long-Term Incentives Granted: | $ | 2,325,019 | | | | Long-Term Incentives Granted: | $ | 3,150,014 | |

| Total Actual Compensation: | $ | 3,484,969 | | | | Total Actual Compensation: | $ | 4,081,876 | |

| 60% of 2023 LTIs granted were performance based | | | 60% of 2023 LTIs granted were performance based. Base salary and annual bonus earned are prorated based on the partial year of service; LTIs reflect the full amount granted but will prorate based on the partial year of service. |

Compensation Discussion and Analysis | Compensation Decisions

2024 Compensation Decisions

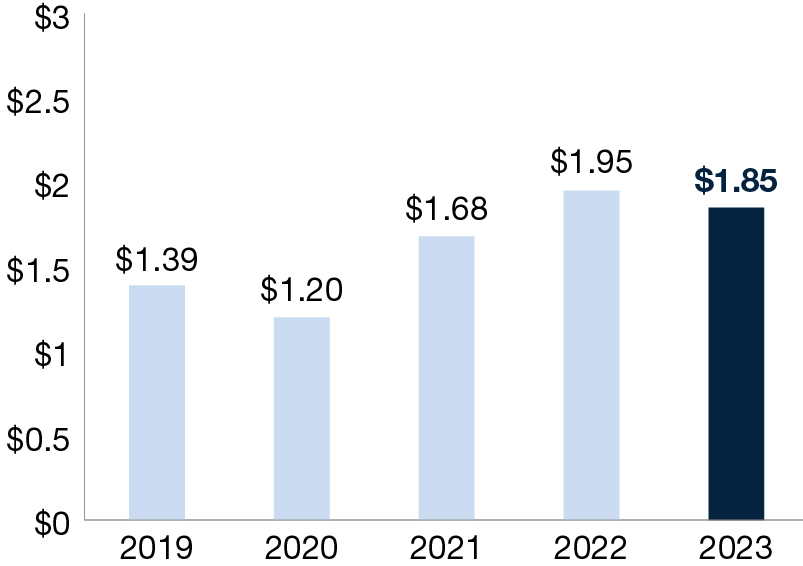

In February 2024, the Board reviewed the compensation levels for Mr. Hinrichs and, based on this review, determined that increases to his annual base salary, target annual bonus opportunity and target long-term incentive opportunity were appropriate. As a result, on February 16, 2024, the Board approved a base salary increase from $1,400,000 to $1,500,000, a target annual bonus opportunity increase from 150% of base salary to 175% of base salary and a target long-term incentive opportunity increase from $10,000,000 to $11,400,000. In addition, the Board approved an increase in the annual cap on the aggregate incremental cost to the Company of Mr. Hinrichs’ personal use of corporate aircraft that will be covered by the Company from $175,000 to $250,000.

When the Board appointed Mr. Hinrichs as President and CEO in September 2022, the Board set Mr. Hinrichs’ compensation at a level intended to compensate him fairly, while also acknowledging that he was new to the rail industry and aiming to provide a runway with him to increase his compensation over time, as warranted. Specifically, the Board anticipated that if Mr. Hinrichs performed in a manner commensurate with the Board’s hopes and expectations and was able to make measurable progress on some of the Company’s key strategic goals, including (i) building and improving the overall CSX culture and morale among employees, (ii) increasing service levels and customer engagement and (iii) continuing the Company’s efforts to increase safety, then the Board would want to increase his compensation over time. The Board believes that improvements in these areas, while continuing the Company’s operational excellence, will unlock additional opportunities for CSX and increase its competitiveness and shareholder value over the long term.

Over his first 18 months at CSX, Mr. Hinrichs has exceeded the Board’s expectations in virtually all of these areas.

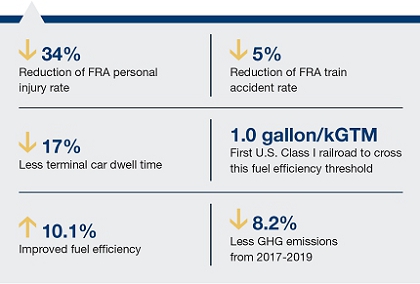

nMr. Hinrichs has truly transformed the Company’s culture. He has championed the ONE CSX culture by actively engaging on the ground with employees and advancing cultural changes. This has resulted in significant improvement in employee engagement and satisfaction, and Company culture has gone from being a pain point to an area of great pride.

nMr. Hinrichs has led negotiations to make CSX the first U.S. railroad to come to agreement with unions to provide paid sick leave to union employees of certain crafts—a critical step in preventing a nationwide railroad strike—and is continuing to lead the industry for the next round of collective bargaining set to kick off later this year.

nFrom a service perspective, Mr. Hinrichs has supported CSX becoming an industry leader in service. Under his leadership in just the first year of his tenure, the Company has the best and, importantly, most consistent level of service to its customers as reflected in nearly every customer service metric in the industry. With Mr. Hinrichs as our President and CEO, CSX was the first railroad to be released from Surface Transportation Board (STB) reporting of certain of these metrics.

nOn safety, CSX has been one of the leaders among Class I railroads with the lowest number of injuries in 2023 and the second lowest train accident rates in an environment where the Company was training over 2,000 new train and engine service employees. Unfortunately, rail is an inherently dangerous industry and there have been some challenges, including three fatalities in 2023. The Board believes that the changes in culture described above and Mr. Hinrichs’ commitment to improving safety at all levels and decision to bring on an industry veteran Chief Operating Officer, Michael A. Cory, will yield improvement to the Company’s safety record.

Moreover, these goals were achieved on top of continued strong financial performance, with CSX outperforming most rails (all but Canadian Pacific Kansas City Limited) on revenue growth in 2023.

The Board believes that the foundational changes that Mr. Hinrichs has been able to implement will make CSX stronger and more successful over the long term, and the Board believes that it is in the Company’s best interests to recognize and reward him for his work thus far and continue to incentivize him over the coming years. Notably, most of the increases in compensation provided to Mr. Hinrichs are in the form of performance-based compensation, and so Mr. Hinrichs will only experience these increases if the Company continues to meet or exceed its financial and operational goals.

Compensation Discussion and Analysis | 2023 Base Salary 2023 Base Salary

The Committee determines a base salary for

the CEO and each

executiveNEO annually based on its assessment of the individual’s scope of responsibilities, performance and experience. The Committee also considers salary data for similar positions within the Comparator Group. After considering this information and in light of the economic environment,

including the impact of the COVID-19 pandemic on CSX, the Committee

did not increase the base salary of any of the NEOs in 2020.made adjustments for certain NEOs. Base salary may represent a larger or smaller percentage of total compensation actually paid, depending on whether actual Company and individual performance under the short and long-term incentive plans

discussed herein fall short of or exceed the applicable performance targets.

2020

In 2023, the Committee reviewed the annual compensation of the Company’s NEOs and approved, or recommended Board approval in connection with the CEO, changes to base salaries that reflected the consideration of market data, individual performance, overall responsibilities, internal equity and functional experience.

In January 2023, the Committee approved a base salary increase for Mr. Pelkey, Executive Vice President and Chief Financial Officer, to $660,000, based on performance, achievement of his 2022 goals and positioning within the Comparator Group. This adjustment was effective as of January 1, 2023. The CEO and no other NEOs received a base salary increase in 2023.

| | | | | | | | | | | | | | |

| NEO | 2023 Annual Base Salary | Changes from 2022 | Reasons for Changes |

| Joseph R. Hinrichs | | $ | 1,400,000 | | — | % | No change from 2022 |

| Sean R. Pelkey | | $ | 660,000 | | 10 | % | Due to performance, achievement of his 2022 goals and positioning within the Comparator Group |

| Kevin S. Boone | | $ | 725,000 | | — | % | No change from 2022 |

| Stephen Fortune | | $ | 650,000 | | — | % | No change from 2022 |

| Nathan D. Goldman | | $ | 570,000 | | — | % | No change from 2022 |

| Jamie J. Boychuk | | $ 725,000* | — | % | No change from 2022 |

* Mr. Boychuk was involuntarily separated without cause under circumstances that made him eligible for severance benefits under the Company’s executive severance plan in August 2023. His actual base salary paid in 2023 was $433,424.

Short-Term Incentive Compensation

Goal Setting Process for

2020the 2023 MICP

In January 2020,2023, the Committee established and approved the goalsmeasures and measurestargets under the 20202023 Management Incentive Compensation Plan (the “2020 MICP”)(MICP) and developed a performance structure to drive business results and create value for shareholders. The 2020 MICP was designed to leveragedeliver results that drive profitability, improve safety, enhance customer service and grow revenue, while optimizing assets and controlling costs. In addition to the financial and customer service goals, the Committee included ESG-focused measures related to safety and fuel efficiency in the plan. The Committee established the following target 2023 MICP incentive opportunities (“Target Incentive Opportunity”) for each NEO.

| | | | | |

| NEO | Target Incentive Opportunity

(% of Base Salary) |

| Joseph R. Hinrichs | 150 | % |

| Sean R. Pelkey | 100 | % |

| Kevin S. Boone | 100 | % |

| Stephen Fortune | 100 | % |

| Nathan D. Goldman | 90 | % |

| Jamie J. Boychuk* | 100 | % |

* Mr. Boychuk was involuntarily separated without cause under circumstances that made him eligible for severance benefits under the Company’s successful transitionexecutive severance plan in August 2023. His actual 2023 MICP payout was prorated to scheduled railroading, an operating model that has enhanced customer service levels allowing the Company to focus on new business opportunities and revenue growth. reflect his partial year of service.

The

20202023 MICP was structured to reward executives and eligible employees for driving Company performance over a one-year period. Each NEO was provided

an incentive opportunitya Target Incentive Opportunity based on the goals established by the Committee expressed as a percentage of base salary earned during the year

(“Target Incentive Opportunity”).and positioning of similar roles in the Comparator Group. In

2020,2023, the Target Incentive Opportunity level for Mr.

FooteHinrichs was

160%150% of base salary,

and 90%100% of base salary for Messrs. Boone, Boychuk,

Fortune and Pelkey and 90% of base salary for Mr. Goldman. The Target Incentive Opportunity levels for Messrs. Hinrichs, Boone, Boychuk, Fortune and Goldman

remained the same as in 2022. The increase in the Target Incentive Opportunity of 90% to 100% for Mr. Pelkey was driven by the responsibilities of his role and

Wallace.2020the positioning of similar roles in the Comparator Group.

Compensation Discussion and Analysis | Short-Term Incentive Compensation

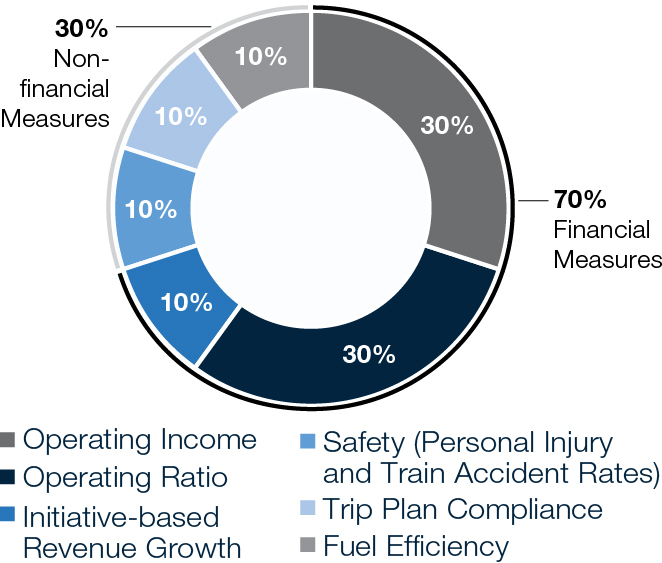

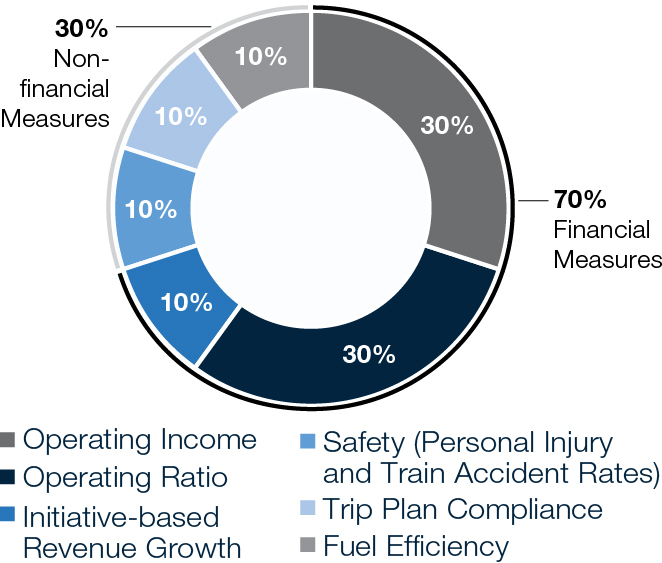

2023 MICP Performance Measures

In January

2020,2023, the Committee approved the performance measures for the

20202023 MICP, which included

operating income, operating ratiofinancial performance measures, and

operational, customer service and ESG-related measures of safety

improvement targets. Eachand fuel efficiency. The financial measures account for 70% of

thesethe MICP’s overall weighting. These measures have

proven to bebeen critical drivers of CSX’s business success.

In an effort to enhance focus on sustainable growth, theThe Committee

adjusted theapproved weightings

for each of the

operating income and operating ratio metrics from 45% each under the 2019 MICP to 60% and 30%, respectively, under the 2020 MICP. The safety metrics remained at a 10% weighting under the 2020 MICP.Operating Income (60%) |

|

Directly tied to Operating Ratio targets and gauges the general health of the core business - quantifying our profitability. |

|

Operating Ratio (30%) |

|

A key indicator of the Company’s efficiency, this measure helps us maintain focus on maximizing the value of our service product, as well as ensuring that our processes are safe and cost efficient, which are main themes of our guiding principles. |

|

Safety (10%) |

|

Added in 2019 and continued in 2020, FRA Personal Injury and Train Accident rates underscore the critical importance of intensifying our focus on injury and accident prevention. |

performance measures as set forth below.

To determine the payout under the MICP, the Committee first assesses the Company’s performance against each of the performance goals for the year. These Company performance measures can result in a payment between 0% and 200% of the NEO’s Target Incentive Opportunity. In addition,

Upward or downward payout adjustments may be made based on a determination of exceptional individual performance; however, no individual performance adjustments were applied to 2023 payouts for any NEO. The individual performance modifier has been a standard component of the MICP design for over 10 years. Last year, after the voting results of our 2022 “Say-on-Pay” proposal and intensive shareholder outreach and engagement efforts focused on our executive compensation program, the Committee re-evaluated the circumstances under which individual performance adjustment(s) might be appropriate and determined that such circumstances should be exceptional. To build on that commitment, the Committee recently enhanced the rigor around the review process—through which the Committee determines payout adjustments—to ensure that such process evaluates truly exceptional achievement against pre-established performance goals set at the beginning of the year, as well as other outstanding accomplishments that impact shareholder value creation, our customers and employee culture. No individual performance adjustments were applied to 2023 payouts for any NEO.

Upward payout adjustments for each of the NEOs are capped at 150% of the Company’s MICP payout, with a maximum total payout under the MICP of 250% of the NEO’s Target Incentive Opportunity. If the Committee believes that any instance of adjustment is merited—upward or downward—fulsome and specific disclosure of how compensation decisions are tied to goals and performance will be provided. As shown in the “Summary Compensation Table,” the 2023 MICP payouts were based solely on the Company’s financial and operational performance.

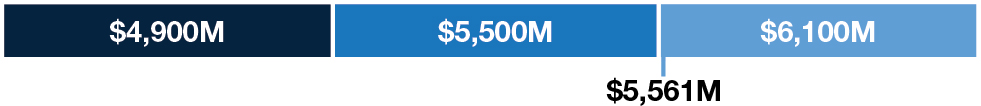

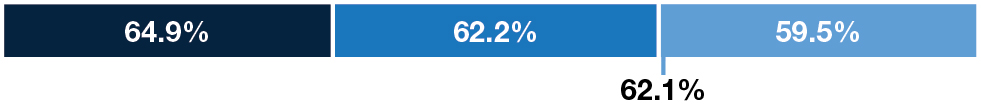

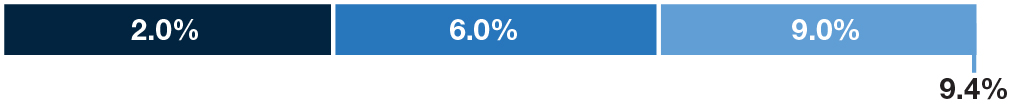

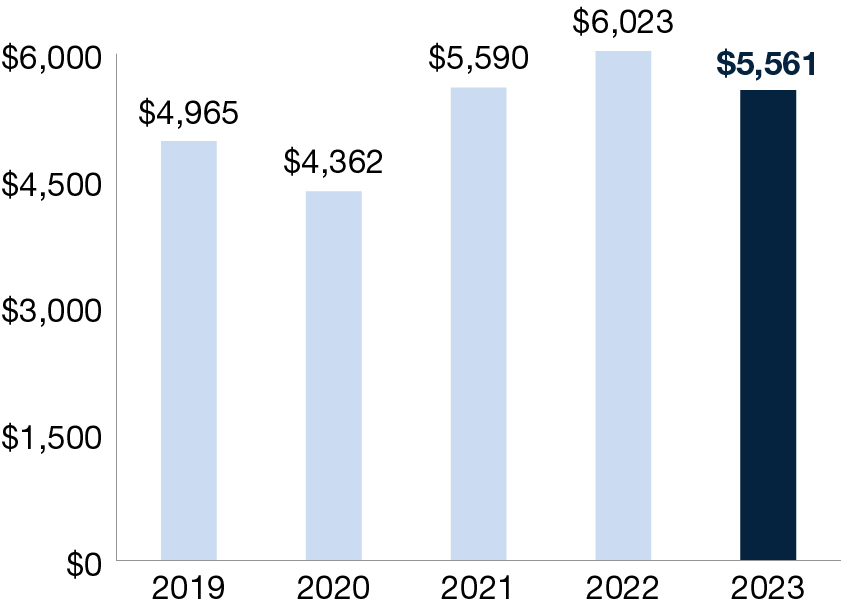

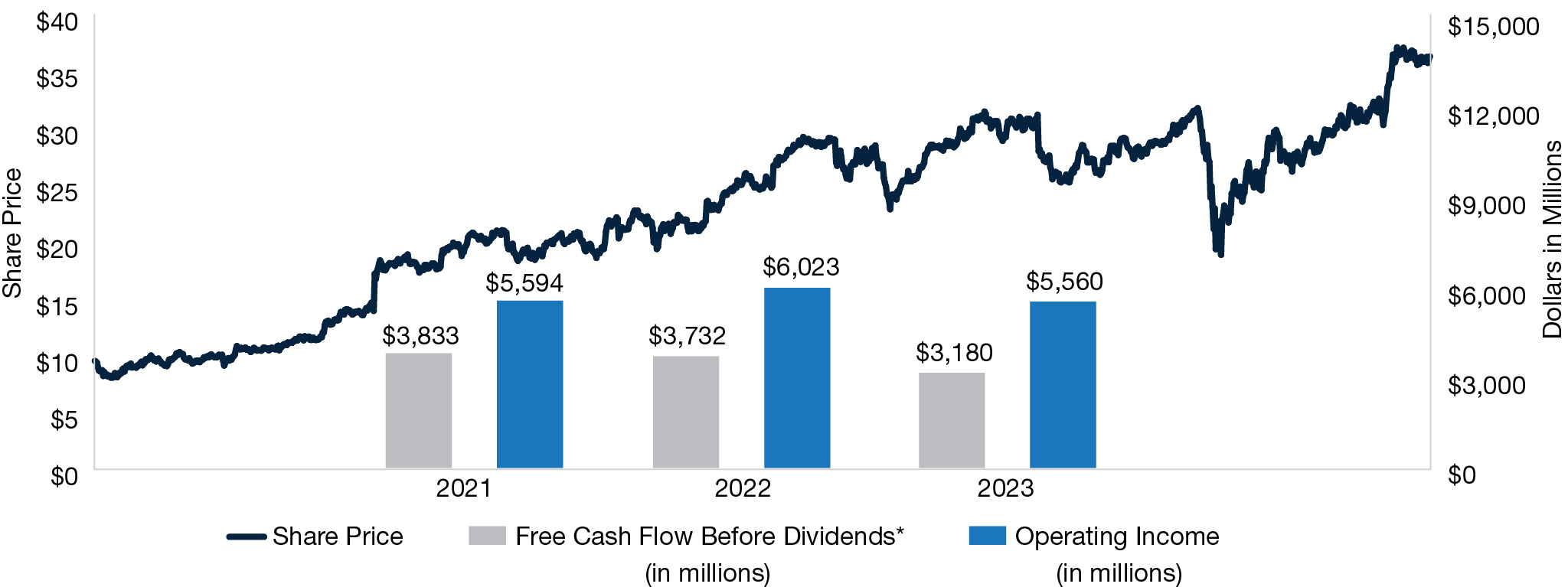

2023 MICP Targets and Payout Percentages

In light of the continuing economic uncertainties and high inflation that existed in January 2023 when the 2023 MICP was adopted, the Committee approved annual incentive targets reflective of the challenging economic environment and with a wider performance range that would continue to build on the Company’s strong customer service levels and drive new business opportunities and revenue growth. As such, the 2023 MICP operating income target was set $523 million below the 2022 MICP operating income actual. The Company was cycling $238 million of prior year real estate gains and expected a normalizing supply chain environment to result in reduced intermodal storage revenue as well as lower export coal pricing. The Company disclosed that, as expected, actual 2023 results were impacted by the prior year Virginia real estate transaction, declining intermodal storage revenue and lower export coal benchmarks, totaling nearly $700 million of operating income impact on a combined basis.

Compensation Discussion and Analysis | Short-Term Incentive Compensation

The specific threshold, target and maximum payout goals and applicable weighting for each performance measure are set forth in the table below.

The Committee believes that the measures for the MICP were directly aligned with the Company’s strategic short-term goals, are directly impacted by executive leadership actions, supported our long-term strategy, helped deliver shareholder value and ensured retention of critical talent. The following table demonstrates the Company’s 2023 achievements against each target and the overall resulted payout.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Performance Measure(1) | Threshold(1) (0% – 50% payout) | Target

(100% payout) | Maximum

(200% payout) | Individual Measure Payouts | | Resulted Company Payout | | Total Payout for All NEOs |

| Financial Goals – 70% weighting | | | | | |

| Operating Income (30% weighting) | | 33% | | | | |

Operating Ratio(2) (30% weighting) | | 32% | | | | |

Initiative-based Revenue Growth(3) (10% weighting) | | 20% | | 115% | | 115%(5) |

ESG (Safety and Environmental) and Operational Goals(4) – 30% weighting | | | |

| FRA Personal Injury Rate (5% weighting) | | 10% | | |

| FRA Train Accident Rate (5% weighting) | | 0% | | | | |

| Trip Plan Compliance (10% weighting) | | 20% | | | | |

| Fuel Efficiency (10% weighting) | | 0% | | | | |

(1)Performance measure payouts are determined independently and each measure could result in a threshold payout range from 0% to 50% as shown, where applicable, in the table.

(2)The 2023 MICP allowed a formulaic adjustment to the operating ratio performance goal by a predetermined amount if the average cost of highway diesel fuel was outside the range of $4.00 to $4.50 per gallon. This adjustment is designed to account for the potential impact that volatile fuel prices have on expenses and operating ratio. Because the 2023 average price per gallon was $4.21 for highway diesel fuel, which was within the range, there was no adjustment to the operating ratio goals.

(3)Initiative-based Revenue Growth is a non-GAAP measure calculated by the amount of newly generated line-haul revenue associated with specific customer initiatives in the year. Line-haul revenue is the revenue generated from moving traffic, excluding fuel surcharge, before any costs or expenses are deducted.

(4)Certain safety actuals and operations performance can continue to settle over time. The Company’s 2023 achievements demonstrated in this table reflect actuals as of around the time the Committee approved the overall resulted payout in early 2024.

(5)No individual performance adjustments were applied to 2023 payouts for any NEO.

The Committee annually assesses the individual performance of each NEO and determines payout amounts, which are capped at the maximum Company payout of 250% of target for 2023. Based on the 2023 accomplishments for each NEO as described above, the Committee did not exercise its discretion

allows forto make upward or downward payout adjustments based on individual performance

for any NEO, and

/ or in the case of exceptional circumstances such as those experienced in 2020. As shown in the Summary Compensation Table, the 2020 MICP payouts reflect the Company’s financial and operational performance, and individual NEO performance, taking into account the Committee’s exercise of discretion to recognize the successesapproved a 115% total annual incentive payout for each of the

management team in the midst of the COVID-19 pandemic.44 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

2020 MICP Targets and Payout Percentages

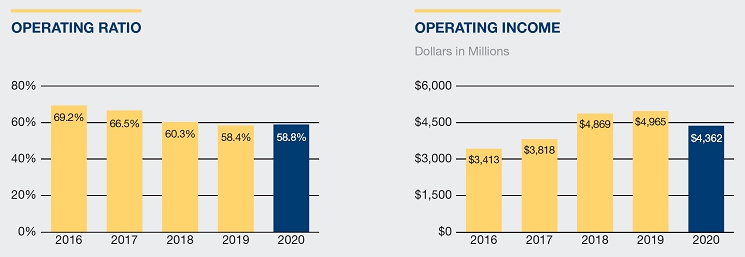

Given CSX’s strong performance in 2019 and to accelerate our business transformation, we set the 2020 annual incentive targets with significant stretch and with much narrower performance shoulders than had been our practice. The 2020 MICP was designed to leverage the Company’s strong customer service levels to create new business opportunities and grow revenue. The charts below illustrate the very narrow performance shoulders for both operating income and operating ratio in the 2020 MICP.

The Committee approved an operating income target for the 2020 MICP of $4.93 billion and an operating ratio target of 58.1% (adjusted for the actual average price of highway diesel fuel)NEOs based on the Company’s business plan. The threshold payout level for operating income and operating ratio were $4.83 billion and 58.6%, respectively. The 2020 operating income target of $4,930 million was set lower than the 2019 target and 2019 actual results of $4,955 million and $4,965 million, respectively, due to adjustments made to 2019 results based on one-time extraordinary items. These items, totaling $95 million,115% resulted in normalized 2019 results of $4,870 million, which was the basis for the 2020 operating Income targets. In addition, the 2020 MICP also included safety improvement targets for FRA Personal Injuries and FRA Train Accidents of 0.86 and 2.20, respectively.

Assessing 2020 Performance in the COVID-19 Environment

The COVID-19 pandemic significantly disrupted our business in a manner that, in the opinion of the Committee, rendered the performance goals under the 2020 MICP no longer attainable for purposes of measuring and rewarding the performance of our management team in 2020. As previously noted, in the second quarter, CSX experienced the largest quarterly volume declines in Company history. In light of the continuing uncertainty and volatility related to the pandemic, the Committee chose not to reset the goals under the 2020 MICP during the performance period. Instead, the Committee indicated that it would use a principled approach to assessing payouts based on overall Company performance during the year focusing on five key areas:

| n | Actions taken to keep employees, customers and the communities in which CSX operates safe; |

| n | The direct impact of COVID-19 on performance and what performance would likely have been excluding the impact of COVID-19; |

| n | CSX performance on critical operational and financial metrics, relative to the other Class I railroads; |

| n | Actions by management to manage the impacts of COVID-19, while also maximizing Company performance and positioning the Company for growth; and |

| n | Shareholder experience over 2020. |

The Company performed well above target levels during the first quarter of 2020 (producing a record first quarter operating ratio of 58.7%), which the Company believed to be a signal of strong performance to come over the rest of the year. With the onset of the COVID-19 pandemic, which began to impact the Company’s business performance during the second quarter of 2020, the financial and operational targets under the 2020 MICP became unachievable. In the second quarter, volume and revenue dropped 20% and 26%, respectively.

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Notwithstanding the historic disruption caused by the COVID-19 pandemic, our management team demonstrated exceptional performance that proved critical to our Company’s overall success in 2020 in the following five key areas:

SAFETY: | Actions taken to keep employees, customers and the communities in which CSX operates safe. |

| n | The Company invested $10 million to protect its employees by prioritizing health and safety, and accelerating the Company’s total well-being strategy. |

| n | In response to the impact of the COVID-19 pandemic, the Company quickly developed and implemented technology solutions enabling remote work capabilities and efficiencies. |

| n | Management was able to minimize the impacts of the pandemic on the workforce by maintaining base salary levels and creating a furlough mitigation program. |

| n | The Company also actively engaged in messaging and implementing an action plan regarding social unrest and racial equity, engaging in conversations with union leaders and advocating at the local, state and federal government levels on behalf of CSX and the industry. |

| | |

| | |

IMPACT OF COVID: | The direct impact of COVID-19 on performance and what performance would likely have been excluding the impact of COVID-19. |

| n | CSX had a record operating ratio in the first quarter of 2020. |

| n | Excluding second quarter results, CSX would have achieved a maximum payout under the operating ratio performance measure, which would have produced an MICP payout of 60% on this measure alone. |

| | |

| | |

PERFORMANCE

RELATIVE TO PEERS: | CSX performance on critical operational and financial metrics, relative to other Class I railroads. |

| n | CSX performance remained strong relative to class I peers, leading the industry in volume performance while continuing to deliver significant cost savings. |

| n | The Company continued to be an industry leader in safety, achieving record low numbers in personal injuries in 2020, which was the lowest among its Class I peers. |

| n | The total number of train accidents was 16% lower than in 2019, but the lower volumes resulted in fewer train miles, and a corresponding increase in the Company’s train accident rate in 2020. |

| | |

| | |

PERFORMANCE,

GROWTH & SUSTAINABILITY: | Actions to manage COVID-19 impacts, while maximizing performance and positioning for growth. |

| n | The Company effectively managed the network through periods of extreme volatility to drive additional structural efficiencies and create incremental operating leverage in both rapidly declining and rapidly rebounding volume environments, all while continuing to prioritize safety. |

| n | The Company was able to realize significant revenue growth in certain markets through efforts by the Sales and Marketing team during the pandemic to leverage its customer relationships. |

| n | As volumes declined with the onset of the pandemic, the Company found ways to control or reduce expenses by taking actions and driving productivity in asset efficiency, engineering, fuel savings and reduced overtime. These efforts resulted in a total year-over-year expense reduction of $751 million. |

| n | Swift actions taken to reduce cash outflows on both the expense and share buyback side, coupled with a debt issuance in March and elevated cash balances entering 2020 resulted in $3.8 billion of available liquidity at the end of the second quarter of 2020, when the impact of the pandemic was at its strongest. |

| n | The Company continued to be an industry leader in ESG performance for its achievements in sustainability, diversity and inclusion, community service and emissions reduction, receiving multiple accolades in these areas, including recognition by the Wall Street Journal as the highest ranking company in sustainability in the transportation sector. |

| n | The Company also became the first U.S. Class I railroad to operate at a fuel efficiency rate of less than one gallon of fuel per thousand gross ton miles for a quarter. |

| | |

| | |

VALUE CREATION: | Shareholder experience over 2020. |

| n | By virtue of management executing a rapid response plan with the onset of the COVID-19 pandemic, CSX was able to reinforce customer confidence and maintain its operating and service advantage over other railroads. |

| n | In connection with these efforts, CSX stock prices reached an all-time high of $93.71 in 2020, with total shareholder return of 27.1% for the year. |

46 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The Committee believes that these achievements are aligned with the Company’s strategic short and long-term goals, which are directly impacted by executive leadership actions, support our long-term strategy, help deliver shareholder value and ensure retention of critical talent. The Committee also believes that while sustained improvements in operating efficiencies and the focus on growth will continue to play a critical role in the creation of shareholder value, our management team was able to deliver shareholder value under exceptional circumstances, while positioning the Company to grow volumes as consumer demand returns.

The 2020 MICP allowed for the Committee to exercise its discretion in making payouts above actual results. In light of the achievements of our management team described above and their performance in the face of the unprecedented challenges brought on by the COVID-19 pandemic, the Committee determined that it was appropriate to make payments to each of our NEOs under the 2020 MICP at 75% of their respective Target Incentive Opportunities. The Committee believes that the payout was aligned with the overall business performance and stakeholder experience in 2020. The payout consisted of 10% of the Target Incentive Opportunities based on safety performance for 2020, and 65% of the Target Incentive Opportunities based on the Committee’s discretion in recognition of our NEOs performance during 2020, measured relative to the five key areas of focus.payout. These payouts are reflected in the “Bonus” and “Non-Equity Incentive Plan Compensation” columns, respectively,column of the Summary“Summary Compensation Table. While the NEOs received a payout of 75% for the 2020 MICP, eligible management employees who achieved performance expectations (approximately 2,500 employees) received an annual incentive compensation payout of 100% of their TargetTable.”

2024 Management Incentive

Opportunities.2021 MICPCompensation Plan Design

The 2021 MICP2024 Management Incentive Compensation Plan (MICP) design continues to emphasize financial, safety, operating income and operating ratio with the addition of other operational and ESG-focusedenvironmental performance measures which include customer service, fuel efficiency and initiative-based revenue growth. The addition of these measures is designed to enhance focus on items that employees have the ability to directly influence, align to shareholder expectations and support the One-CSX initiative. The goalONE CSX strategy. Operating margin replaced operating ratio to support the Company’s continued focus on profitable growth while emphasizing the importance of cost control and asset utilization. In addition, in furtherance of the “One-CSX” initiative isCommittee’s commitment to promote a culture, rooted in a set of core values, that positionsenhance the Company torigor around its MICP review process, the 2024 MICP includes pre-established individual performance goals against which adjustments for exceptional performance and outstanding accomplishments will be an employer of choice to attractdetermined.

Compensation Discussion and retain the best talent and assure that every employee understands and delivers on strategic priorities.

Analysis

| Long-Term Incentive Compensation Long-Term Incentive Compensation

The Company’s long-term incentive compensation program is intended to:

| n | Engage and reward employees for extraordinary results that will maximize shareholder value; |

| n | Reinforce a pay-for-performance culture with a significant portion of total compensation at risk; and |

| n | Align NEO interests with those of shareholders with a focus on generating sustainable performance over a multi-year period. |

nengage and reward employees for extraordinary results that will maximize shareholder value;

nreinforce a pay-for-performance culture with a significant portion of total compensation at-risk; and

nalign NEO interests with those of shareholders, with a focus on generating sustainable performance over a multi-year period.

These goals are accomplished by providing equity-based incentives focused on financial performance measures that: (i) have a historically high correlation to shareholder returns; (ii) are within management’s direct control; and (iii) encourage long-term commitment to delivering shareholder value. Long-term incentives have been granted under the shareholder-approved 2010 CSX Stock and Incentive Award Plan (the “2010 Stock Plan”) and 2019 Stock and Incentive Award Plan (the “2019 Stock“Stock Plan” and together with the 2010).

The Stock Plan

the “Stock Plans”).The Stock Plans allowallows for different types of equity-based awards and provideprovides flexibility in compensation designdesigned to attract, retain and engage high-performing executives. The Committee determines the mix of equity vehicles annually to ensure alignment with market practice, motivate appropriate long-term, results-driven behaviors, and align Company and NEO performance towith shareholder interests and maximizedrive value creation.

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Elements of Long-Term Incentive Compensation

The Long-Term Incentive Plan (“LTIP”) provides a

A significant portion of the NEOs’

compensation.target compensation is comprised of the Long-Term Incentive Plan (LTIP) awards. Each year,

the Committee, as part of its annual review process, determines a market competitive long-term incentive target grant value

is determined by the Committee for each NEO,

as part of the Committee’s annual review process, based on factors described above andwhich is then converted into the

appropriatecorresponding value of

equityequity-based awards.

The awards have generally consistedFor 2023, the LTIP grants for the NEOs were comprised of performance units,

and non-qualified stock options. The number of performance units is determined based on the award value divided by the average closing value of CSX common stock for the full three-month period prior to the grant. The number of non-qualified stock options

is determined based onand restricted stock units, which were designed to drive long-term value and growth through the

award value divided by the Black-Scholes value for that same period.achievement of Company performance goals and increased stock prices. The grants associated with each three-year cycle are reviewed and approved by the Committee each year for the NEOs and other eligible

participants.participants, and by the Board for the CEO. These grants are made and the performance targets

are set following the annual Board review of the Company’s business plan for the applicable upcoming three-year period.

For 2020, as part of its review process, the Committee increased the incentive target value for Mr. Foote to $11 million and for Messrs. Boone, Boychuk and Wallace to $2.5 million. Each LTIP grant was comprised of performance units and non-qualified stock options awards, which were designed to drive long-term value and growth through the achievement of Company performance goals and increased stock prices.

Since the three-year performance cycles run concurrently, the Company may have up to three active

LTIP cycles during a given year. For example, the

2018-20202021-2023 performance cycle closed on December 31,

2020,2023, and was paid out in January

2021.2024. The

2019-2021, 2020-20222022-2024, 2023-2025 and

2021-20232024-2026 cycles remain in progress, which

helphelps ensure that our employees remain focused on sustainable long-term performance.

Although the goals established under each of the outstanding LTIP cycles have been adversely affected by the impacts of the pandemic, the Committee chose not to reset goals on any of the in-flight plans.Performance Units.

| | | | | | | | |

| Long-Term Compensation Element | Description | Features |

| | |

| Performance Units | nPerformance units are granted at the beginning of the applicable performance cycle, as described below. nAwards are paid in the form of CSX common stock at the end of the performance period based on the level of achievement on Company performance goals. nParticipants also receive dividend equivalents at the end of the restricted period paid in the form of CSX common stock, assuming performance goals are met. | nPerformance units (and related dividend equivalents) are generally subject to forfeiture if a participant’s employment terminates before the end of the performance cycle for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding performance units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, all outstanding performance units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. Mr. Hinrichs will only receive the full vesting of his performance units in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates earn the performance units that they would otherwise have earned at the end of the performance period had there been no death or disability. nPerformance unit payouts for each LTIP cycle, if any, do not occur until approved by the Committee in January of the year following the conclusion of the three-year performance cycle. These payouts can vary from the target grants in terms of: (i) the number of shares paid out due to financial performance; and (ii) the market value of CSX common stock at the time of payout. nBased on actual performance, as discussed below, the performance unit payouts for the NEOs can range from 0% to 250% of the target levels, and can be of lesser or greater value than the original grant value based on the level of achievement on the performance goals and the price of CSX common stock. |

| | |

Compensation Discussion and Analysis | Long-Term Incentive Compensation

| | | | | | | | |

| Long-Term Compensation Element | Description | Features |

| | |

| Non-qualified Stock Options | nNon-qualified stock options vest ratably over three years and require stock price appreciation to provide any value to the NEOs. nAs a result, they reinforce leadership’s focus on the importance of value creation for shareholders. Non-qualified stock options generally provide participants with the right to buy CSX stock at a pre-set price for a period of 10 years. nThe exercise price of the non-qualified stock options is established as the closing stock price on the date of grant. The Stock Plan prohibits the repricing of outstanding non-qualified stock options without the approval of shareholders. | nFor outstanding LTIP cycles, non-qualified stock options are subject to forfeiture if a participant’s employment terminates before the end of the vesting period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding non-qualified stock options will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms. Mr. Hinrichs will only receive the full vesting of his award in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates receive all options per the original vesting schedule as if there was no death or disability. |

| | |

| | |

| Restricted Stock Units | nRestricted stock units are time-based awards that vest three years from the grant date (“the restricted period”) for the 2021-2023 and 2022-2024 LTIP cycles. nRestricted stock units for the 2023-2025 and 2024-2026 LTIP cycles are time-based awards that vest ratably over the three year period from the grant date. nAwards are paid in the form of CSX common stock at the end of the restricted period. Participants also receive dividend equivalents at the end of the restricted period paid in the form of CSX common stock. | nRestricted stock units are generally subject to forfeiture if a participant’s employment terminates before the end of the restricted period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. nFor the 2021-2023 and 2022-2024 LTIP cycles, upon retirement—defined as (i) age 65 or (ii) age 55 plus 10 years of service—participants received a prorated portion of their award based on the number of months completed in the cycle. For the 2023-2025 and 2024-2026 LTIP cycles, upon retirement—defined as (i) age 65, (ii) age 60 plus five years of service or (iii) age 55 plus 12 years of service—all outstanding restricted stock units will remain outstanding and eligible to vest based on Company performance through the end of the applicable LTIP cycle. To receive full vesting, NEOs must work through December 31st of the first year of the LTIP cycle and receive consent from the Committee. nThe employment letter for Mr. Hinrichs provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms. Mr. Hinrichs will only receive the full vesting of his award in connection with retirement if he retires after reaching age 60 with five years of service. nUpon death or disability for all LTIP cycles, participants or their estates receive all restricted stock units per the original vesting schedule as if there was no death or disability. |

| | |

Further information regarding the LTIP as described below.grants made to our NEOs in 2023 can be found under the “2023 Grants of Plan-Based Awards are paid in the form of CSX common stock at the end of the performance period based on the level of achievement on Company performance goals. Table.”

Compensation Discussion and Analysis | Long-Term Incentive Compensation

Performance

units are generally subject to forfeiture if a participant’s employment terminates before the end of the performance cycle for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. In such instances, participants generally receive a pro-rata portion of their award based on the number of months completed in the LTIP cycle. Mr. Foote is currently eligible for retirement for purposes of the LTIPMeasures and

his employment agreement provides that, in connection with his retirement, his outstanding performance units will remain outstanding and eligible to vest based on performance through the end of any outstanding LTIP cycles.Performance unit payouts for each LTIP cycle, if any, do not occur until approved by the Committee in January of the year following the last year of the three-year performance cycle. These payouts can vary from the target grants in terms of both the number of shares paid out due to financial performance and the market value of CSX common stock at the time of payout. Based on actual performance, as discussed below, the performance unit payoutsFinancial Goals for the NEOs at the end of the performance cycle can range from 0% to 200% or 0% to 250% of the target grants depending on the cycle, and can be of lesser or greater value than the original grant value based on the level of achievement on the performance goals and the price of CSX common stock.

Non-qualified Stock Options. Non-qualified stock options require stock price appreciation to provide any value to the NEOs. As a result, they reinforce leadership’s focus on the importance of value creation for shareholders. Non-qualified stock options provide participants with the right to buy CSX stock at an agreed-upon price within 10 years of the date of grant. The exercise price of the non-qualified stock options is established as the closing stock price on the date of grant. The Stock Plans prohibit the repricing of outstanding non-qualified stock options without the approval of shareholders. For outstanding2021-2023 LTIP cycles, non-qualified stock options are subject to forfeiture if a participant’s employment terminates before the end of the vesting period for any reason other than death, disability, retirement or other limited circumstances, as approved by the Committee. In such instances, participants receive a pro-rata portion of the award based on the number of months completed in the cycle. The employment agreement for Mr. Foote provides that, in connection with his retirement, the full awards will continue to vest in accordance with their terms.

48 |  |

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Performance Measures for the 2018-2020 LTIP

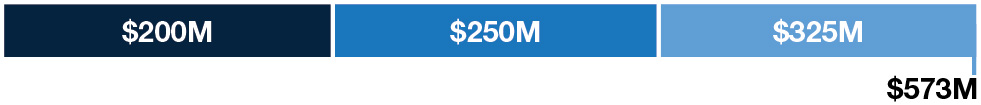

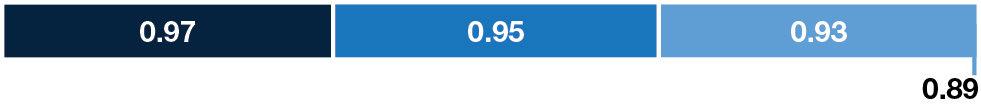

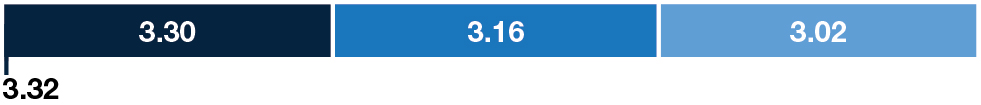

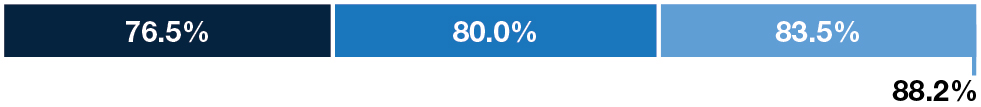

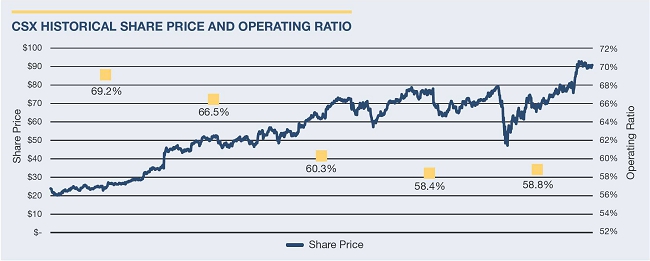

For performance units granted under the 2018-20202021-2023 LTIP cycle, final yearaverage annual operating ratioincome growth rate and cumulative free cash flow were selected and were equally weighted to measure the Company’s performance.

Operating ratio has Average annual operating income growth rate measures the average increase in operating income over the three-year period and was chosen to replace operating income as a historically high correlationmeasure to align with the Company’s stock price and serves asobjective of profitable growth while also providing the ability to recover in the event of a key financial performance measure for CSX and the railroad industry. As such, the use of operating ratio has strengthened participants’ understanding of how they can impact Company performance and drive operating efficiency. Long-term improvements in operating ratio have increased operating income and earnings, and created value for shareholders.prolonged economic downturn. Free cash flow was chosen as a performance measure as it is a key measure of the financial health of the business, and has a high correlation to shareholder returns and aligns with CSX’s financial business plan. Operating ratioAverage annual operating income growth rate and free cash flow were each weighted 50% of the total payout opportunity and were measured independently of the other.

| | | | | | | | | | | | | | |

| Average Annual Operating Income Growth Rate | = | Straight Average of Year-over-Year Change in

[Operating Revenues – Operating Expenses] | | |

| Free Cash Flow* | = | Net Operating Profit – Net Investment in Operating Capital | | |

* Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt.

The threshold, target and maximum payouts for each measure are

10%25%, 50% and 100% of the performance units subject to the award respectively, generating a total target payout of 100% of the performance units and a maximum possible payout of 200% of the performance units for the

2018-20202021-2023 LTIP. The

2018-20202021-2023 LTIP measured

final yearaverage annual operating

ratioincome growth rate and

cumulative free cash flow over a 12-quarter period from January

20182021 through December

2020.2023.

In addition to

average annual operating

ratioincome growth rate and free cash flow, the performance units for

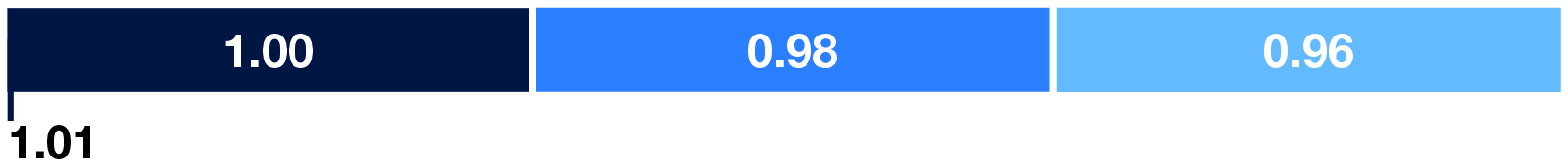

thisthe 2021-2023 LTIP cycle

for all Executive Vice Presidents had a formulaic linear upward or downward relative total shareholder return (“Relative TSR”) modifier of up to 25% (subject to the

200%250% overall cap) based on CSX’s stock price performance compared to the peer group

(weighted 80% core peers and 20% additional correlated companies)(S&P 500 Industrials Index) for the

12-quarter period from January

20182021 through December

2020.2023. In June 2021, Mr. Pelkey assumed the role of Vice President and Acting Chief Financial Officer. As such, the modifier only applied to the performance units he received on June 4, 2021 in relation to his new role and responsibilities. The Committee recognizes that operating ratio is a measure inmodifier did not apply to the shortLTIP performance units granted to Mr. Pelkey on February 9, 2021 as Vice President – Finance and long-term plans, but believes inclusion in both plans reflects the criticality of the alignment between operating ratio and the Company’s focus on operating efficiency. The Committee does not believe this overlap will create inappropriate risk-taking since the measurement periods are different (one vs. three years), and operational measures and reviews are in place to monitor risk. The Committee annually reviews the measures used for each long-term incentive cycle, and makes changes as appropriate.

Financial Goals for the 2018-2020 LTIP

Treasury.

The LTIP targets for the performance units granted under the 2018-20202021-2023 LTIP were set to incentivize long-term shareholder value creation. The goals were set in February 20182021, based on the three-yearthree-year business plan at the time of its adoption. The targets under the 2018-2020 LTIP were as follows:| Final Year Operating Ratio (100% maximum payout) | | Cumulative Free Cash Flow (100% maximum payout) |

| Threshold | | Target | | Maximum | | Threshold | | Target | | Maximum |

| (10% payout) | | (50% payout) | | (100% payout) | | (10% payout) | | (50% payout) | | (100% payout) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| 62.8% | | 61.8% | | 59.8% | | $8,000M | | $8,150M | | $8,500M |

At the time the 2018-2020 LTIP was approved by the Committee, a provision was made

Compensation Discussion and Analysis | Long-Term Incentive Compensation

Payout for the adjustment of the operating ratio performance goals by a pre-determined amount if the average cost of highway diesel fuel was outside the range of $2.75 - $3.25 per gallon. This potential adjustment is designed to mitigate the positive and negative impact volatile fuel prices may have on expenses and operating ratio. Pursuant to the terms of the 2018-20202021-2023 LTIP the final year operating ratio targets were adjusted basedPerformance Units

Based on an average

price per gallonannual operating income growth of

highway diesel fuel of $2.57, which fell below the range of $2.75 – $3.25 per gallon. This adjustment made the operating ratio target more difficult to achieve.Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

Payout for the 2018-2020 LTIP Performance Units

Based on a final year operating ratio of 58.8%9.4% and a cumulative free cash flow of $9.3$10.745 billion for the cycle, the payoutachievement for the performance units, which comprised 60%50% of 2018-2020the 2021-2023 LTIP, was 200% of the target. TheAs shown in the table below, the Company’s Relative TSR performance against the peer group was in the top quartilebelow median for the cycle, providing an upwardresulting in a downward modifier of 125%19% against target performance and an aggregate downward modifier of 38%, butsuch that the maximumtotal achievement was 162% for each of the NEOs other than Mr. Pelkey. Since Mr. Pelkey was not an Executive Vice President at the time of the grant on February 9, 2021, the modifier did not apply and he received a total payout of 200%. Mr. Pelkey was also granted performance units on June 4, 2021 in connection with his promotion to his role as Vice President and Acting Chief Financial Officer. He received a total payout inclusive of the modifier of 162% for the 2018-2020 LTIP was capped at 200% so no upward adjustment was applied.

this award.

* Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt.

| | | | | | | | | | | | | | | | | |

| Threshold

(25% payout) | Target

(50% payout) | Maximum

(100% payout) | | Payout |

| Average Annual Operating Income Growth Rate (50% weighting) | | 200% of Target |

| Cumulative Free Cash Flow* (50% weighting) | |

| Relative TSR (Modifier) | | -19% |

| Total Payout: | | | | | 162% of Target |

* Free cash flow is a non-GAAP measure calculated by using net cash provided by operating activities and adjusting for property additions and proceeds and advances from property dispositions. Free cash flow represents cash available for both equity and bond investors to be used for dividends, share repurchases or principal reduction on outstanding debt.

Compensation Discussion and Analysis | Long-Term Incentive Compensation

Performance Measures

and Equity Award Mix for the Outstanding LTIPs

Performance Measures. In determining the performance measures for the performance units for each LTIP cycle, the Committee: (i) considers information on various growth and return-based measures; and (ii) actively monitors the effectiveness of existing measures in driving the Company’s strategic business objectives and delivering shareholder returns. For performance units, the 2019-2021 LTIP uses operating ratio

| | | | | | | | |

| LTIP Cycle | Performance Measures | Rationale |

| | |

| | |

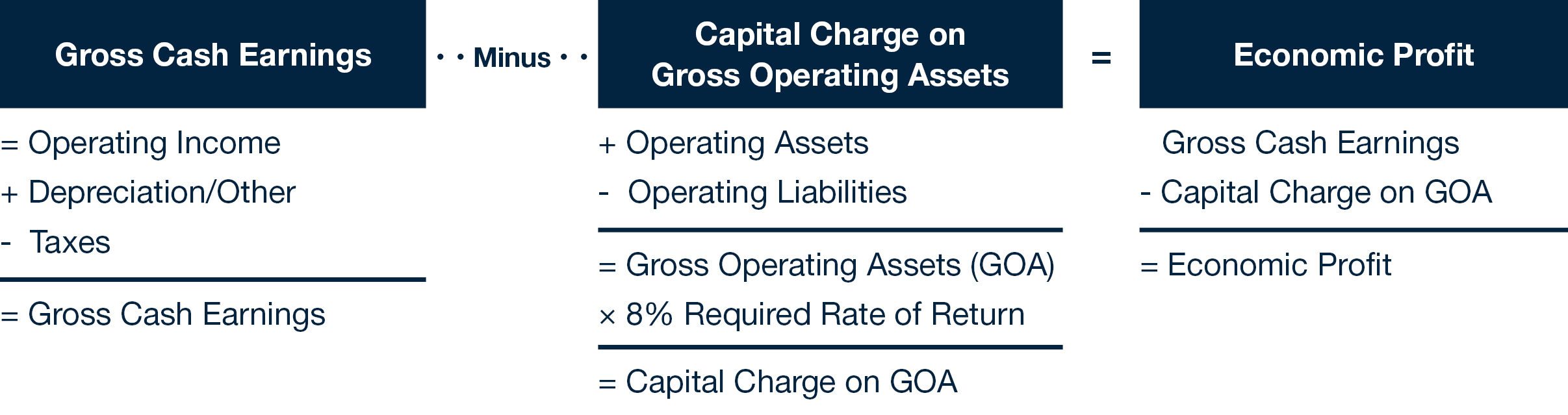

| 2022-2024, 2023-2025 and 2024-2026 LTIP cycles | nAverage Annual Operating Income Growth Rate (50%) nEconomic Profit (CCE) (50%) | nContinued the Company’s focus on driving profitable growth. nEconomic Profit (CCE) is a non-GAAP financial measure designed to measure whether returns on new investments exceed an expected rate of return and to encourage investments in profitable growth projects. Improvement in Economic Profit (CCE) has historically had a strong relationship to stock price appreciation. nAs shown below, Economic Profit (CCE) is calculated as gross cash earnings minus the capital charge on gross operating assets, and Economic Profit (CCE) performance is measured as an improvement versus the prior year’s actual Economic Profit (CCE). nAn Economic Profit (CCE) payout percentage is calculated for each fiscal year during the LTIP cycle, with the final payout percentage determined using an average of the three annual payout percentages. nThis measure was incorporated to drive earnings growth, and to better align compensation to the ONE CSX strategy and to the value created for our shareholders and other stakeholders. nForward-looking LTIP targets are not disclosed for proprietary and competitive harm reasons. |

| | |

| | |

|

| | |

| | |

Compensation Discussion and free cash flow on an equally weighted basis to measure the Company’s performance and the 2020-2022 LTIP uses operating income and free cash flow on an equally weighted basis to measure the Company’s performance. One of the metrics was changed for the 2021-2023 LTIP to address some of the impacts of the economic uncertainty brought about by the COVID-19 pandemic. The 2021-2023 LTIP uses the average annual operating income growth rate and free cash flow on an equally weighted basis, as the performance measures for the performance units. The average annual operating income growth rate measure aligns with the Company’s objective of profitable growth and provides the ability to recover and potentially receive a payout in the event of an economic downturn in one year of the program.The 2019-2021 and 2020-2022Analysis

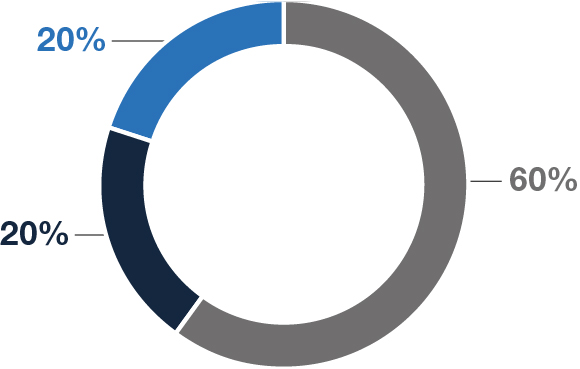

| Long-Term Incentive Compensation Equity Mix. All three outstanding LTIPs are comprised of performance units and non-qualified stock options for the NEOs, and the 2021-2023 LTIP is comprised of performance units, non-qualified stock options and restricted stock units. The number of performance units and restricted stock units awarded to each NEO is calculated based on a specific grant value divided by the average closing price of CSX common stock for the full three-month period prior to the grant. The number of options awarded is calculated based on the Black-Scholes value for the same period.NEOs. For the 2019-20212022-2024 LTIP, the Committee approved a market competitive LTIP grant value for the NEOs (the Board approved for the CEO) allocating 60%50% of the value to performance units, 25% for restricted stock units and 40%25% for non-qualified stock options. The allocation for the 2020-2022 LTIP2023-2025 and 2024-2026 LTIPs was 50%60% performance units, and 50% for non-qualified stock options. Due to continued uncertainty of the macroeconomic environment in light of the COVID-19 pandemic, for the 2021-2023 LTIP, the Committee determined that a more stable equity vehicle was appropriate and approved the inclusion of20% restricted stock units (“RSUs”) for a portion of the LTIP. For the 2021-2023 LTIP, the allocation was 50% performance units, 25%and 20% non-qualified stock option and 25% RSUs. options, to address shareholder concerns of additional performance orientation in the Company’s long-term incentive plan.

| | | | | | | | | | | | | | | | | |

| n | | n | | n | |

| Performance Units | Restricted Stock Units | Non-qualified Stock Options |

| | |

| 2023-2025 and 2024-2026 LTIPs |

| | | | | | | | | | | | | | | | | |

| n | | n | | n | |

| Performance Units | Restricted Stock Units | Non-qualified Stock Options |

The performance units for

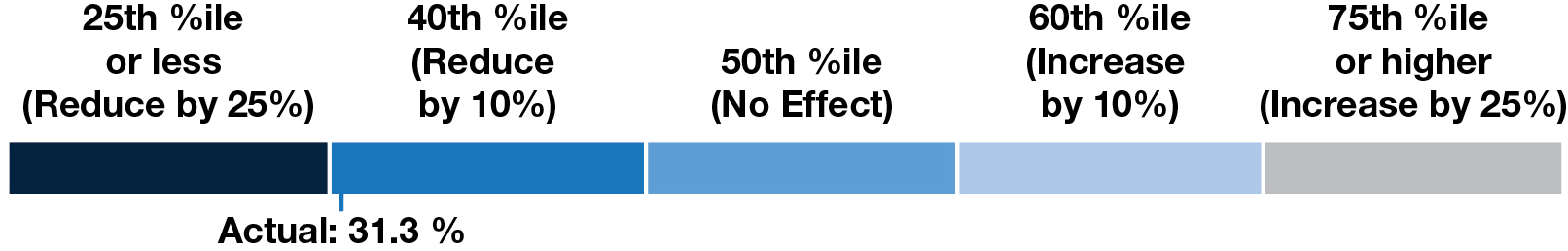

these threethe 2022-2024 and 2023-2025 LTIP cycles have a formulaic linear upward or downward Relative TSR modifier of up to 25% with a maximum payout of 250%, which applies only to the CEO and Executive Vice

Presidents, which includes all NEOs.Presidents. The performance units for the 2024-2026 LTIP cycle have a Relative TSR modifier that recognizes over performance above the 60th percentile and under performance below the 40th percentile with a maximum payout of 250%. Performance between the 61st and 75th percentiles and above would result in an increased payout by up to 25%, and performance between the 25th and 39th percentiles and below would result in a decreased payout by up to 25%. Performance between the 40th and 60th percentiles would result in no modification to payouts. This modifier is designed to appropriately align NEO payouts with share price performance relative to a

transportation-relatedpredetermined peer

group.50 |  |

group, as approved by the Committee at the time of grant. TableFor the 2022-2024 LTIP, the number of Contents

COMPENSATION DISCUSSION AND ANALYSIS

performance units and restricted stock units awarded to each NEO was calculated based on a specific grant value divided by the average closing price of CSX common stock for the full three-month period prior to the month of grant, and the number of options awarded was calculated based on the Black-Scholes value for the same period.

For the 2023-2025 LTIP, the number of performance units and restricted stock units awarded to each NEO was calculated based on a specific grant value divided by the average closing price of CSX common stock for the 30-trading-day period preceding the date of the grant. The number of options awarded was calculated based on the Black-Scholes value for the same period.

The number of performance units and restricted stock units awarded to each NEO for the 2024-2026 LTIP was calculated based on a specific grant value divided by the grant date closing price of CSX common stock. The number of options awarded was calculated based on the Black-Scholes value for the same period.

Clawback

ProvisionProvisions and Policy

Payouts made under the MICP and

LTIPsLTIP programs are subject to recovery or clawback in certain circumstances. Under

suchthe applicable clawback provisions, an employee who has received a payout will be required to promptly return the monies (or any portion of the monies requested by the Company) in each of the following circumstances: (i) if it is determined that the employee engaged in misconduct, including, but not limited to, dishonesty, fraud (including reporting inaccurate financial information), theft or other serious misconduct as determined by the

Company,Company; (ii) if the Company is required to file an accounting restatement due to the Company’s material noncompliance with any financial reporting requirements under

the federal securities

laws,laws; or (iii) if the payout is otherwise required to be recovered by law or court order (i.e.

, garnishment).

In accordance with (ii) above, the Company adopted a separate, stand-alone financial statement compensation recoupment policy pursuant to which incentive-based compensation received by current and former executives is subject to recoupment if the Company is required to restate financial statements due to: (i) an error in previously issued financial statements that is material to the previously issued financial statements; or (ii) an error that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. Under this new policy, when an event that triggers a clawback occurs, recovery is mandatory and no misconduct is required.

Compensation Discussion and Analysis | Employment Agreements Employment Agreements

Mr.

FooteHinrichs entered into an employment

agreementletter upon his

hiringappointment as

Executive Vice President and Chief

OperatingExecutive Officer in

October 2017, whichSeptember 2022 when he was

superseded by anhired. This employment letter

agreement entered into upon his promotion to President and CEO in December 2017. This agreement incorporatedincludes certain provisions

from his prior agreement relating to: (i) severance benefits; (ii) vesting of long-term incentive awards after retirement; and (iii) employment benefits following a change of control.

Mr. Wallace entered into an employment agreement upon his hiring as Executive Vice President in March 2017. This agreement expires on March 29, 2021.

No other NEOs have individual employment letters or agreements. The described individual employment agreements haveletter has been filed and can be reviewedviewed on the U.S. Securities and Exchange CommissionSEC website at www.sec.gov.www.sec.gov. Non-Compete and Non-Solicitation Agreements

The

PresidentCEO and

CEO, executive vice presidents, senior vice presidents, vice presidents, as well as certain other key employees,Executive Vice Presidents are required to enter into formal non-compete and non-solicitation agreements with the Company as a condition for participation in each LTIP cycle. The non-compete

agreement precludesprovisions preclude an executive from working for a competitor of the

Company. The non-compete conditionsCompany and extend for a period of 18 months following separation from employment. The non-solicitation provisions generally prohibit executives from soliciting CSX customers or soliciting, hiring or recruiting CSX employees for any business that competes with CSX for a period of 18 months after separation.

Mr.

FooteHinrichs is eligible for the following severance benefits under his employment letter

agreement with the Company, dated

December 22, 2017: | n | Lump sum cash payment equal to two times his base salary plus two times his target MICP; |

| n | Pro-rataSeptember 26, 2022, in the event of a termination of employment by the Company without “cause” or by Mr. Hinrichs for “good reason” prior to reaching “retirement age”:nlump-sum cash-severance payment equal to two times his current base salary plus two times his target MICP award; npro-rata payment of his MICP award if Company goals are attained; and nunvested equity awards will vest on a pro-rata basis per the original vesting schedules, with any performance-based awards remaining subject to satisfaction of pre-established performance goals. In the event that Mr. Hinrichs’ employment terminates after he reaches “retirement age” (defined to mean his attainment of age 60 plus at least five years of continued service) either (i) by the Company without cause or by him for good reason or (ii) by him due to his voluntary retirement by providing the Company with at least 180 days’ notice of his plans to retire, Mr. Hinrichs will receive, in lieu of any of MICP award; and |

| n | Unless he is terminated for cause, his unvested equity awards will remain outstanding and vest per the original vesting schedules, with any performance-based awards remaining subject to satisfaction of pre-established performance goals. |

Mr. Wallace is eligible for the following severance benefits underdescribed above, continued vesting of his employment agreement with the Company dated March 29, 2017:

| n | Pro-rata vesting of his unvested equity awards, per the original vesting schedules, with any performance-based awards remaining subject to satisfaction of pre-established performance goals; |

| n | Pro-rata payment of MICP award; |

| n | Lump sum cash payment equal to two times his base salary plus two times his target MICP; and |

| n | Reimbursement for all reasonable relocation costs for moving outside the Jacksonville area to another primary residence in North America if relocation is within one year of termination of employment |

unvested equity awards, subject to any relevant performance criteria.

As of December 31,

2020,2023, Messrs. Boone,

Boychuk,Fortune, Goldman and

GoldmanPelkey were eligible for benefits under the Company’s

generalexecutive severance

policy availableplan that was implemented in September 2022 and amended in July 2023. The executive severance plan was amended, in part, with the intention to

all management employees.further clarify certain terms regarding the treatment of a participant’s outstanding equity awards in the event of a qualifying termination of employment with the Company. Under the

generalexecutive severance

policy,plan, the NEOs are eligible to receive: (i) severance

based on tenure (certain weekspay equal to the sum of

one times the current base salary

based on CSX yearsand one times the current target bonus under the MICP; (ii) a pro-rata bonus under the MICP in the plan year of

service); (ii)the termination; (iii) continuation of medical and dental coverage for up to

one year if periodic separation payments are selected; (iii)12 months; (iv) financial planning for

up to one

year; and (iv)year following termination; (v) prorated vesting of

certain outstanding

equity incentive